More shoppers, more often in 2024 - and they plan to shop online more in the next 5 years

Record number of households shopping online

Millennials were the most frequent online shoppers in 2024, with 44% buying weekly.

Gen Zs shopped multiple times a month, while Gen Xs, Baby Boomers, and Builders shopped monthly.1

Gen Zs, Millennials, and Gen Xs plan to shop online more over the next 5 years2

- Gen Z

- Millennials

- Gen X

- Baby Boomers

- Builders

Frequency of online purchases (2018 vs 2024)

1 in 5 households shopped online weekly in 2024, up from just 5% in 2018. This suggests that households are now significantly more active online than they used to be, and they are shifting their spending from in-store to online.

Your next step:

Build personalised experiences to attract future shoppers

Our customers told us they wanted more value beyond product and price, so we're on a journey to reposition the 'e' in eCommerce from 'electronic commerce' to 'experiential commerce'.

We aim to evolve from a site that was mostly transactional to one that leverages what makes us unique - data for personalisation and gamification, brand stories and coffee expertise to educate and elevate your coffee experience.”

Personalised experiences are top of the list for the younger generations, including Gen Z and the upcoming Gen Alpha. Generative AI is the future of personalisation, so we asked Microsoft for tech tips.

Personalisation is transforming the online shopping experience.

The expectation of personalisation will be especially pronounced in Gen Alpha, who have grown up in households of smart devices, apps delivering food, and personalisation. For Alphas, algorithms and personalisation are an integrated and expected part of the consumer experience. Retailers that meet these expectations will drive stronger engagement and lasting loyalty.”

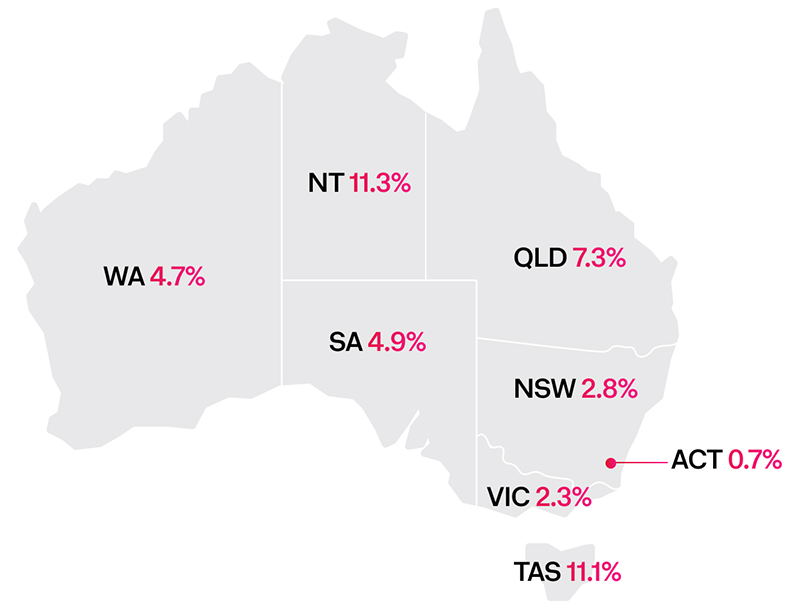

Regional areas outpaced metro, highlighting opportunities for targeted marketing

YoY growth in number of households shopping online

- Regional

- Metro

Top locations for online shopping

Top locations by

volume

| Postcode | Name | State |

|---|---|---|

| 4350 | TOOWOOMBA | QLD |

| 4740 | MACKAY | QLD |

| 3030 | POINT COOK | VIC |

Top locations by

volume per capita

| Postcode | Name | State |

|---|---|---|

| 2000 | SYDNEY | NSW |

| 2015 | ALEXANDRIA | NSW |

| 4184 | MACLEAY ISLAND | QLD |

Top growth suburbs

by volume

| Postcode | Name | State |

|---|---|---|

| 3336 | FRASER RISE | VIC |

| 4680 | GLADSTONE | QLD |

| 4184 | MACLEAY ISLAND | QLD |

Growth in online purchases YoY

We saw divergent spend by state and region.

Perth, Adelaide, Brisbane and regional areas around the country raised spending. Meanwhile, in Sydney, Melbourne and Canberra, higher household debt, higher home prices and a greater sensitivity around higher interest rates really reined in spending.”

Your next step:

A targeted approach to marketing and fulfilment

Our initial method was simply replenishing from a single distribution centre in Australia.

But with high DIFOT (delivery in full on time) requirements, we went on a large journey to manage all eCommerce deliveries and B2B transfers from 148 fulfilment centres around the country. That was a key enabler around our inventory agility - so, if you're in Darwin and you place an order online, it could be shipped from the store down the road from you instead of from a distribution centre in another state.”

Targeted

marketing

Increase paid digital ads and social media campaigns in the regions of interest to your business.

Localised

promotions

Tailor special offers to the preferences of each region, with a focus on high-activity areas. That could include free shipping for certain states or metro areas.

Shipping

success

With customer spending strong in regional areas, make sure you work with a delivery partner that has a presence in locations right around Australia.

Omnichannel

fulfilment

A strategic omnichannel approach can speed up delivery. That was the experience of Michael Hill Jewellers (see above).

62% of shoppers switched brands to save money - making loyalty a priority for retailers

Average number of online retailers shopped per year

Through the course of 2024, consumers were seeking the cheapest price, so they were shopping around a lot more than they were maybe a few years ago.

But there were very large differences between the age cohorts. Younger age groups adopted more savvy spending: they looked at online marketplaces and discount department stores, and shopped around for discounts. But people over 60 weren't as exposed to the cost-of-living pressures, so they were generally raising spending across the board.”

We're focused on nurturing existing customers - creating personal relationships, suggesting relevant products to them and incentivising people to stay with us - instead of pouring every ounce of energy into finding new customers.”

Your next step:

Create meaningful rewards to boost customer loyalty

Build trust

- All generations agree that product quality builds trust and loyalty

- Gen Zs and Millennials trust brands that regularly connect with them on social media, fostering a sense of community

- Gen Zs are more likely than other generations to trust brands whose values align with theirs

- Baby Boomers and Builders value honesty and transparency

To stand out, we don't take shortcuts - we make our branding very consistent and transparent. Reviews are important for that transparency.

It's very easy as an eCommerce business to control what reviews look like on your website, but a platform like Google Reviews is totally out of your control - so we had Google Reviews up from day one.”

Offer meaningful rewards

Shoppers across the generations define 'meaningful rewards' as having tangible and financial benefits. Their top preferences for loyalty programs in the next 5 years are:3

70% want a loyalty program to offer free shipping

58% want discounts or cashback on future purchases

56%want free gifts or samples

The loyalty program offers that are least interesting to shoppers include invitations to exclusive events or experiences.

All online sale events grew in 2024 - and shoppers plan to hit sales even more in 2025

Growth in online purchases during sale events (YoY)

There are 24% more households active during sale events compared with the rest of the year.

The people who purchase in the sale period have the biggest spend throughout their customer lifetime. So we build up our email list before each sale event, and then work hard to keep people engaged through the sale.”

More people plan to shop sale events in 2025, with Gen Z leading the way1

- 76% Gen Z

- 67% Millenials

- 47% Gen X

- 24% Baby Boomers

- 82% Gen Z

- 78% Millenials

- 60% Gen X

- 35% Baby Boomers

Your next step:

Your future customers want more personalised sale offers

Dig into your existing data to find which sale offers worked well with which customers over the last year. This can help you identify what they already like, and think creatively about new ways to make them happy over the coming years.

Our strategy is about growth, so post-event we look at the learnings and plan for the next peak event.

One thing that became clear during the last event is that we must communicate those plans to our delivery partner. Plenty of early communication with our forecasted volumes means when we hand over parcels for last-mile delivery, there's enough capacity within Australia Post to deliver our customer service experience.”

74% of Gen Zs and Millennials shop and browse products via social media, mainly on Instagram, Facebook and TikTok.2

Nearly half of Gen Zs and Millennials who shop and browse products on social media do so weekly. 80% do this at least once a month, mainly for fashion.2

The top 4 things Gen Zs and Millennials like about shopping on social media2

56%Discovery

39%Convenience

28%Brand story

27%Influencers

Australia's social commerce reached $4.9 billion in 2024 and is expected to grow to $8 billion by 2029. Globally, social commerce makes up nearly 20% of all eCommerce.6

Gen Zs and Millennials plan to shop more on social media in the next 5 years2

- Gen Z

- Millennials

- Gen X

- Baby Boomers

- Builders

Navigating how to speak to my audience through social media was a big challenge for me.

Competition is rising and most of the other businesses in this space are run by Gen Zs who know their way around social media, especially TikTok. I've thrown myself into it now and found it's very consumer-centric. You can gain insights on what your customer likes rather than just blindly forcing your products onto them. I started studying what my customers want and how I could fix that, shifting my mindset from my product to solving a problem.”

Your next step:

Tap into the next big social media trends

Experiment with different platforms and content types

To attract a young audience, you need to create the content styles they like in the places they gather. The best way to approach social media trends is via experimentation: try different styles on various platforms, and then measure what works and what doesn't.

Watch and listen

Absorb yourself in the platforms, trends and content that your target audience is following, to help your thinking align with current trends.

Collaborate with influencers

Working with the people who bring the trends to life is a great way to stay ahead of the social media curve. Open a dialogue with the influencers you're keen to work with, to create content that's authentic to both your brand and the content creator while being on-trend.

Stay true to your brand

No trend is worth sacrificing the essence of your brand for, so make sure you only follow the trends that are a good fit with your products and messaging.

TikTok Shop is leading a transformation in how customers learn about and shop for merchandise.

This is a channel that actually favours local brands, because you're telling and selling a story; the key is to tap into people's curiosity and desire to be part of trends that are interesting. Australia is still a little behind on this, but we expect it to grow in 2025.”

Shoppers preferred saving money over buying sustainably in 2024, boosting the next trend: recommerce

More than two-thirds of shoppers thought sustainable new goods were too expensive in 2024. As a result, buying second-hand items grew in popularity, with one-third purchasing pre-loved goods to save money and be sustainable, while a quarter bought used items just to save money.4

Where Australian shoppers buy second-hand goods4

Gen Z

- Facebook

Marketplace - Depop

Millennials

- Facebook

Marketplace - Amazon Renewed

Gen X

- eBay

Baby Boomers and Builders

- Facebook

Marketplace - eBay

Recommerce: the US$248 billion global trend

Gen Zs and Millennials plan to buy more second-hand goods in the next 5 years2

- Gen Z

- Millennials

- Gen X

- Baby Boomers

- Builders

Your next step:

Ride the growing wave of recommerce popularity

Your business can leverage the rise of second-hand shopping by launching a B2C recommerce model for certified pre-owned products. This approach appeals to cost-conscious and sustainability-minded shoppers, particularly Gen Zs and Millennials.

Offering second-hand items can attract new customers, with the potential for them to buy new products later.

Amazon Renewed

Businesses who are registered sellers with Amazon can access the marketplace's platform for pre-owned and refurbished goods.

IKEA Buyback

and As-is

The furniture and homewares giant buys pre-loved goods in exchange for a store credit, then puts them into their As-is market to be found by new owners.

lululemon

By calling their recommerce model 'Like New' and marketing it as a sale point for 'gently used gear', the activewear business reinforces their focus on quality.

Decjuba

In 2024, Decjuba launched a partnership with resale platform Authentified - customers log in to their account and choose the item they want to resell. Once sold, the platform creates a shipping label to keep the process easy.

74% of Gen Zs and Millennials shop via social media - almost half do this every week